Editor's PiCK

US-China Trade Hegemony Struggle... Is Bitcoin Benefiting?

공유하기

- It was reported that if capital outflow occurs due to China's yuan devaluation, interest and investment in Bitcoin could increase.

- It was analyzed that the conflict with the Chinese government would positively affect the Bitcoin price increase, and past cases also prove this.

- It was reported that the instability caused by the US-China trade conflict and currency war would rather lead to increased global interest in decentralized assets.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Intensifying US-China Tariff War

China Attempts to Offset Tariff Impact by Devaluing Yuan

Bitcoin Expected to Rise with Chinese Capital Outflow

"Interest in Decentralized Assets Will Grow"

The trade hegemony struggle between the United States and China is escalating. Amid increasing uncertainty in the risky asset market, there is an analysis that the US-China conflict could actually be beneficial for Bitcoin.

On the 11th (local time), the Chinese government announced that it would raise tariffs on US imports from the existing 84% to 125%. This is a retaliatory measure following US President Donald Trump's announcement on the previous day (10th) to immediately raise tariffs on Chinese imports from the existing 104% to 145% (including fentanyl tariffs).

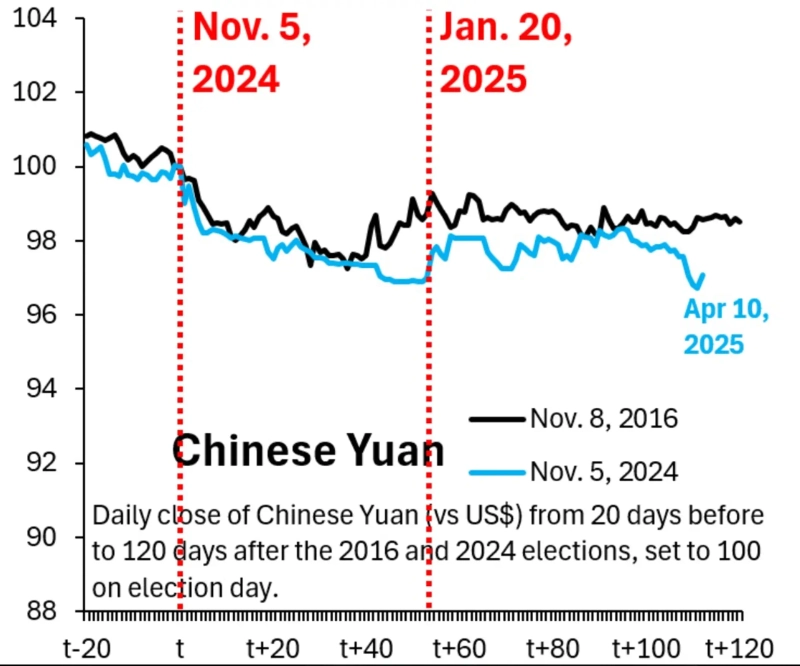

The tariff war showed signs of leading to a currency war as well. This is because China is attempting to devalue the yuan against the dollar to offset the tariff shock from the US. When the yuan's value falls, the export price of Chinese products decreases, allowing China to partially offset the impact of US tariffs.

On the 14th (local time), the People's Bank of China announced the reference exchange rate against the dollar at 7.2110 yuan per dollar (with a daily fluctuation limit of ±2%), renewing the lowest reference rate in 1 year and 7 months. This figure significantly exceeds the 7.2 yuan per dollar that the Chinese government has adhered to.

The movement to devalue the yuan by China is expected to continue. US investment bank Wells Fargo predicted, "The speed of the yuan's value decline will gradually accelerate. China will attempt a deliberate value drop of up to 15% over the next two months." Investment bank Jefferies also assessed, "China may lower the yuan's value by up to 30%." However, President Trump strongly criticized this, saying, "China is manipulating the currency," further escalating tensions between the US and China.

Weak Yuan, Positive for Bitcoin... "Chinese Capital is Coming In"

However, there is also an opinion that the currency war stemming from the tariff war could actually be beneficial for Bitcoin. As the yuan's value falls, capital outflow from China could help raise Bitcoin prices.

When the yuan's value decreases, the value of assets within China also declines. In this case, Chinese asset holders are more likely to convert their existing assets into foreign currency or transfer them overseas to preserve asset value. However, the Chinese government has been sensitive to capital outflow overseas, restricting individual foreign exchange purchases (up to $50,000 annually).

Accordingly, Chinese asset holders have shown a tendency to use Bitcoin as an alternative to preserve asset value whenever the yuan's value decreases. Unlike other assets such as gold, real estate, and art, Bitcoin guarantees decentralization and anonymity, making it easy to store assets and move them overseas without government surveillance.

Past cases also prove this. The year 2013, when the Chinese government imposed capital movement restrictions as the yuan's value fell, is representative. At that time, Bitcoin trading volume in China surged, and Bitcoin prices rose from $13 to $1,163 in just one year, an increase of about 8800%.

The same was true in early 2015. When the People's Bank of China lowered the reference exchange rate of the yuan against the US dollar by about 1.9%, Bitcoin, which was traded at around $321 at the beginning of the year, reached $900 by the end of 2016. In 2017, when the first US-China tariff war broke out, it was expected that the yuan's value would continue to decline, and Chinese-based virtual asset exchanges such as Huobi accounted for 90% of the world's Bitcoin trading volume, indicating a significant correlation between the Chinese exchange rate market and Bitcoin.

Accordingly, major industry figures also expressed expectations for the rise of Bitcoin due to the weak Chinese yuan. Arthur Hayes, co-founder of BitMEX, said on X (formerly Twitter), "The decline in the yuan's value means that Chinese capital is flowing into Bitcoin," adding, "Considering past cases in 2013 and 2015, Bitcoin could see similar price increases this year."

Ben Zhou, founder of Bybit, also expressed expectations for a Bitcoin rebound, saying, "When the yuan's value decreases, a lot of Chinese capital flows into Bitcoin, positively affecting price increases."

"Rise of Decentralized Value... Possibility of Holding Bitcoin Instead of Dollars"

Additionally, there is a view that the currency war caused by the anti-market actions of the Trump administration could act as a boon for Bitcoin, not only in terms of price increases but also in improving perception and expanding global influence.

Richard Teng, CEO of Binance, said, "Although there is great volatility in the virtual asset market due to the sovereignty disputes of various countries, this could increase global interest in Bitcoin's decentralization."

Matt Hougan, CIO of Bitwise, said, "There is no asset to replace Bitcoin in times when the global economy is shaking and monetary policy is unstable." He explained that in situations where the decisions of each country, such as tariff disputes or exchange rate policies, are unpredictable, the demand for assets beyond government control increases.

He continued, "The reason governments and companies stockpile and rely on dollars is because of the dollar's stability," predicting, "Due to the current actions of the US, the dollar is losing trust. In the future, the movement to stockpile Bitcoin instead of dollars will grow."

However, there were also criticisms that there are tasks to be addressed first for the global adoption of Bitcoin. Byungjun Kim, an analyst at Dispread, said, "Even if the perception of Bitcoin improves, related regulations and infrastructure improvements must be made first for it to lead to actual global adoption."

![[New York Stock Market Briefing] Closed lower on AI concerns… Broadcom plunged in the 5% range](https://media.bloomingbit.io/PROD/news/b07399a5-fad3-4406-971e-042ab70ad61d.webp?w=250)