Editor's PiCK

Narrative, Airdrop, and Bitcoin: Korean Crypto Weekly [INFCL Research]

Summary

- Bithumb and Upbit recently showed contrasting new listing strategies, aiming to capture emerging narratives through listings.

- SOON attracted strong interest from the Korean community through NFT airdrops and KOL-centered marketing.

- Bluefin dispelled initial concerns by recording excellent price performance after TGE.

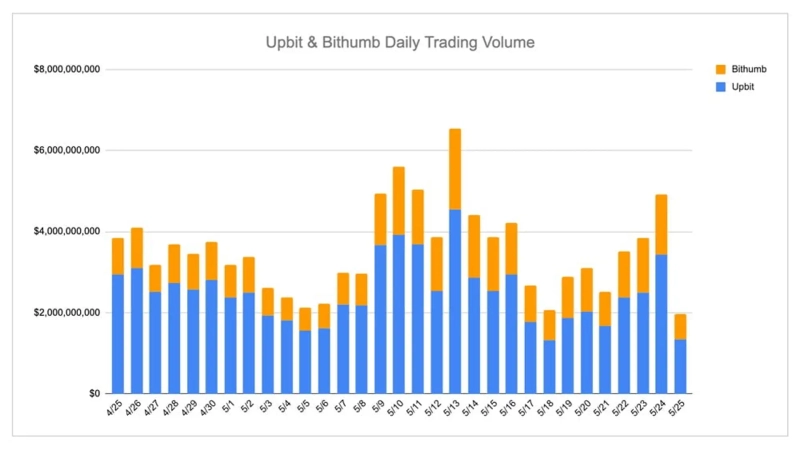

1. Market Overview

Last week, Korean virtual asset (cryptocurrency) exchanges showed contrasting strategies. Bithumb continued its aggressive new listings, while Upbit maintained a more selective approach. Both exchanges listed NEXPACE, but Bithumb also added Bluefin(BLUE), SOON(SOON), and Wayfinder(PROMPT) to capture emerging narratives (SVM, Perp DEX growth).

SOON attempted an effective entry into the Korean market through KOL exposure, NFT role assignment, and community airdrops, while Bluefin dispelled doubts about its delayed launch with performance gains.

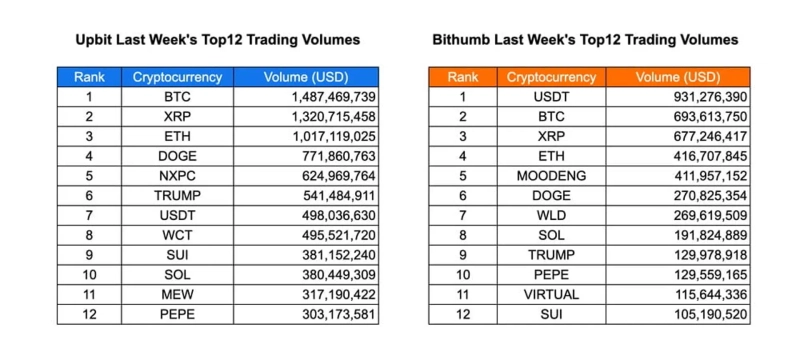

Looking at trading volume data, Upbit showed strength in major stocks like BTC, XRP, and ETH, and mid-sized thematic stocks like NXPC and WCT also stood out. On the other hand, Bithumb had high trading volumes in region-based tokens like USDT and MOODENG, with TRUMP and DOGE ranking in the top 6 on both exchanges, reflecting individual investors' interest in meme coins.

2. Exchanges

2-1. Newly Listed Stocks

Last week, major Korean virtual asset (cryptocurrency) exchanges listed several new stocks:

Upbit listed Mantra(OM).

Bithumb listed Wayfinder(PROMPT), Bluefin(BLUE), and SOON(SOON).

2-2. Major Marketing Strategies and Insights

SOON

As the SVM-related narrative emerged, market interest increased due to the influence of SonicSVM, and SOON leveraged this well. With the popularity of the NFT project Mad Lads, SOON gained community attention by assigning roles to NFT holders.

SOON entered the Korean market in January 2025, emphasizing connections with Solana founders and notable investors (e.g., Hack VC), and induced word-of-mouth in KOL-centered Telegram channels. Subsequently, NFTs were sold under lock-up conditions, with some quickly selling out, and the remaining stock was distributed to buyers, building trust.

The airdrop was conducted through the Kaito platform, and thanks to the solid existing community, it received natural interest and reactions compared to other projects. Continuous AMAs and news sharing maintained interest until the TGE point. As a result, many Korean community users received the airdrop, and the TGE response was positive.

Bluefin

Bluefin is a Perp DEX (perpetual futures decentralized exchange) based on the Sui ecosystem, which began to build recognition in the Korean market from 2023. As the Sui ecosystem continued to show strong development capabilities and major projects launched successfully, expectations for the ecosystem as a whole began to rise among Korean users.

However, Bluefin took a relatively long time from the start of marketing in the Korean market to the TGE (Token Generation Event) compared to other projects. Paradoxically, as Bluefin was part of the Sui ecosystem and received more attention than other Perp DEXs, the community continuously expressed dissatisfaction with the unclear TGE schedule.

In fact, as the TGE continued to be delayed, some community users expressed disappointment by nicknaming it "Rugfin."

However, when the TGE finally took place, Bluefin recorded excellent price performance, quickly dispelling previous concerns.

In the Korean market, Perp DEX projects tend to face more criticism than other sector projects when TGE is delayed.

2-2. Trading Volume

Last week, major Korean exchanges showed distinct differences in listing activities. Upbit adopted a cautious few-listing strategy, while Bithumb aggressively listed various new stocks such as Wayfinder(PROMPT), Bluefin(BLUE), and SOON(SOON). Notably, both exchanges listed NEXPACE, which quickly emerged as a top trading asset.

SOON actively utilized SVM (Solana Virtual Machine) related expectations and KOL-centered marketing to attract strong interest from the Korean community even before listing, and Bluefin overcame skeptical views with excellent price performance after a long wait for TGE.

Trading volume was strong on both exchanges.

Upbit still held a trading advantage in major stocks like BTC, XRP, and ETH, and new assets like NXPC and WCT also had a significant impact on the market.

Bithumb recorded particularly high trading volumes in USDT and MOODENG, reflecting a different type of user base.

The difference in top trading stocks between the two exchanges suggests differences in individual investors' preferences and investor composition.

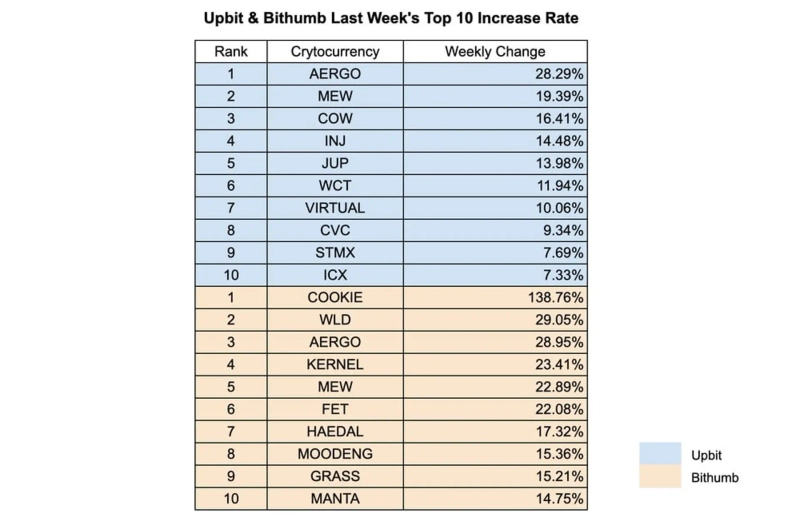

2-3. Top Weekly Yield Stocks

This week, trading volume remained stable, but overall yields were low, with a clear difference in yields between Upbit and Bithumb. AREGO was the only stock listed on both exchanges among the top yield stocks. However, AREGO also showed yield differences depending on the exchange.

Upbit's top yield stock was AREGO (28%),

while Bithumb recorded the highest yield with COOKIE (138%).

Bithumb showed relatively more stocks with strong yields. COOKIE (138%), WLD (29%), and AREGO (29%) ranked high in yields, showing a higher ROI concentration than Upbit.

3-1. Kaito Leaderboard and the Rise of Korean 'Yappers'

Active participation of Korean 'Yappers' (enthusiastic Kaito community participants) is evident in various projects within the Kaito platform.

Projects like Mantle, Virtuals, OpenLedger, and Skate are standing out, with Virtuals receiving particularly strong reactions. This is due to the following key factors:

Quick Reward Distribution:

Unlike most projects that distribute airdrop rewards over several months, Virtuals distributes rewards on a weekly basis. This allows users to immediately convert their activities into real rewards, providing short-term participation motivation as well as positively impacting long-term user retention.

Practicality of Rewards:

Virgin Points distributed by Virtuals are not just honorary points but can be used to access launchpad investment opportunities at a market cap of about $200,000. This reduces investment risk while allowing users to experience the actual UX of the product, playing a significant role in forming high trust and loyalty within the Korean community.

3-2. Bitcoin Pizza Day Lands in Korea

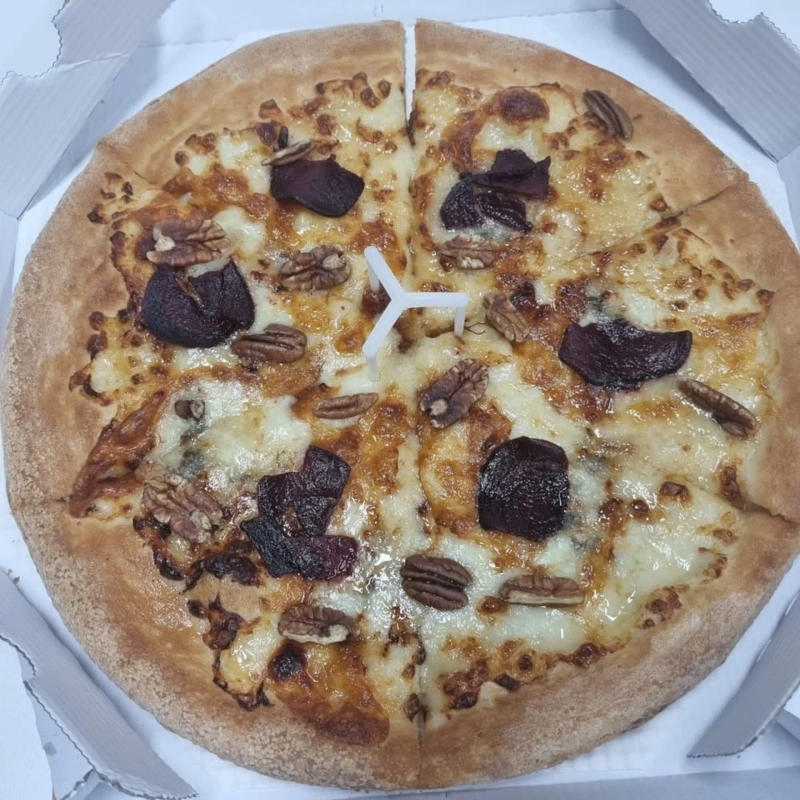

On May 22, to celebrate Bitcoin Pizza Day, Korean crypto brands actively participated. BNB Chain, Flipster, IRYS, and Bitget conducted various social campaigns, but the most notable was Upbit.

Upbit collaborated with Chef Yoon Nam-no to present a special 'Upbit Pizza' at his restaurant Dippin.

This pizza, themed around Bitcoin, used 100% domestically sourced beets (vegetables) as toppings, incorporating a pun with 'BTC.'

Reviews praised the pizza as a sweet gorgonzola style, with honey, nuts, and surprisingly delicious roasted beets in harmony. This event was noted as a unique attempt to add local sentiment to a global crypto holiday.

3-3. Crypto Enters Politics: One Week Until the Korean Presidential Election

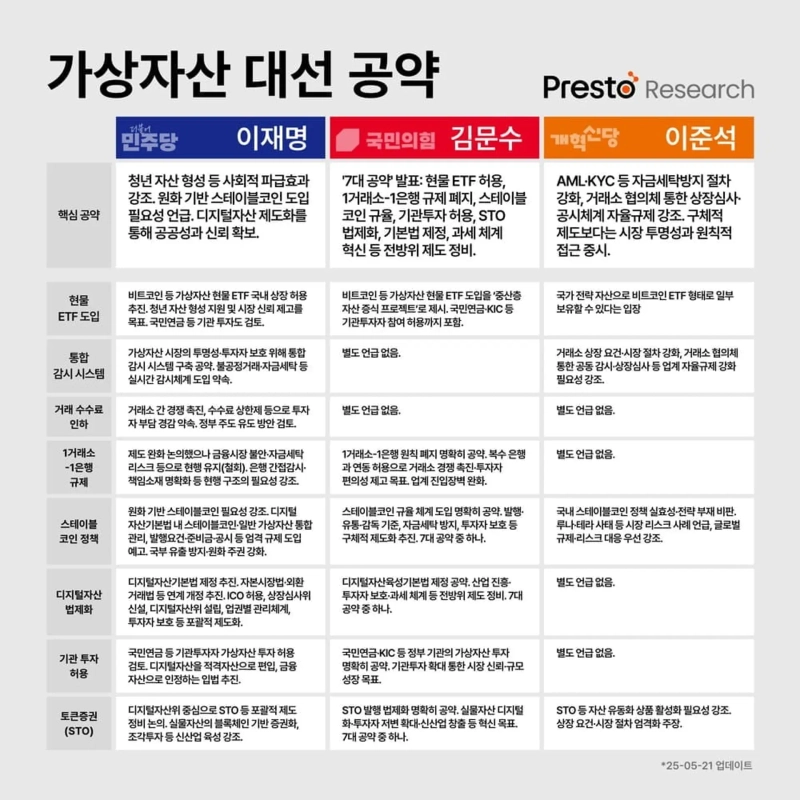

With just a week left until the Korean presidential election, virtual asset policy has emerged as a key issue.

As the Korean presidential election approaches, virtual asset (cryptocurrency) policy has become a key topic. An image summarizing the candidates' positions quickly spread on Korean Twitter, drawing attention, and the main points are as follows:

Lee Jae-myung (Democratic Party):

Proposes allowing Bitcoin spot ETFs, legalizing stablecoins, and establishing a dedicated digital asset department.

Emphasizes protecting individual investors, including the MZ generation.

Kim Moon-soo (People's Power):

Supports allowing ETFs and announced seven regulatory easing policies, including abolishing the 'one exchange-one bank' rule and accepting stablecoins.

Lee Jun-seok (Reform New Party):

Takes a more cautious stance, emphasizing transparency and anti-money laundering (AML) issues.

Leaves the possibility of ETF introduction open but focuses on managing risks related to stablecoins.

*All content is written for information and provision purposes only and is not intended as a basis for investment decisions or as a recommendation or advice for investment. The content of this document does not take responsibility for any part of investment, legal, tax, etc.

INF Crypto Lab (INFCL) is a consulting firm specializing in blockchain and Web3, providing one-stop services for companies' Web3 entry strategies, token economy design, and global market entry. It offers strategy formulation and execution services to major domestic and international securities firms, game companies, platform companies, and global Web3 companies, leading sustainable growth in the digital asset ecosystem with accumulated know-how and references.

This report is independent of the media's editorial direction, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)