Trump: "China to Supply Rare Earths First, US Agrees to Allow Chinese Students"

Summary

- President Trump stated that the US and China have reached an agreement in their high-level trade talks regarding China's supply of rare earths and the acceptance of Chinese students in the US.

- China's rare earth export restrictions have had a major impact on the global automotive, defense, and energy sectors, causing a significant increase in the prices of some rare earth elements.

- Industry stakeholders remain concerned that the rare earth supply chain could again be disrupted even after the US-China agreement, extending uncertainty for related industries.

US-China Trade Deal Results Disclosed on SNS

"Only Xi Jinping's and My Final Approval Remains"

Donald Trump, President of the United States, announced on the 11th that the framework for a US-China trade agreement, held in London, United Kingdom, has been completed. He particularly emphasized that agreements were reached regarding China's supply of rare earths to the US and the acceptance of Chinese students in the US.

President Trump posted on his Truth Social that "the trade deal with China has been completed and only the final approval from President Xi Jinping and myself is needed."

Just one day after US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, among other representatives, reached a framework for implementing the US-China Geneva trade deal in high-level talks in London on the 9th and 10th (local time).

President Trump stated that "China will supply permanent magnets and all necessary rare earths up front," and "we will provide what was agreed upon, including Chinese students, to China."

On the previous day, US Commerce Secretary Howard Lutnick stated, "We have agreed on a framework to implement the Geneva deal."

Meanwhile, President Trump wrote, "We will apply a total of 55% tariffs (on China), and China will apply 10% tariffs (on the US)," adding, "The (US-China) relationship is excellent."

Currently, the US tariff rate on China is down to 30%, and China's tariff rate on the US is also down to 10%. The 55% tariff rate on China mentioned by President Trump is interpreted as the combined total of about 20% in tariffs that the US has imposed on China since before the start of Trump’s second administration.

China’s ‘Rare Earth Hegemony’ Forces Even Unyielding Trump to Compromise

Geneva Agreement Implementation Framework Set… Positive Trade Signals for US-China Tariff Talks

The background for President Donald Trump recently setting aside his pride and speaking with Chinese President Xi Jinping, as well as the US holding a second round of high-level negotiations with China in London, was China’s rare earth export controls. Last month, China restricted rare earth exports in response to US tariff actions, which directly impacted the global automotive industry, including the US. Lesser-known sectors such as defense, healthcare, and energy also suffered significant blows due to the critical need for rare earths in these industries.

◇ US Desperate for Rare Earths

US Commerce Secretary Howard Lutnick said on the 10th (local time), "Solving rare earth regulations is the core of this framework." The US and China agreed in their second round of high-level negotiations to draft a framework for the implementation of the first-round agreement last month.

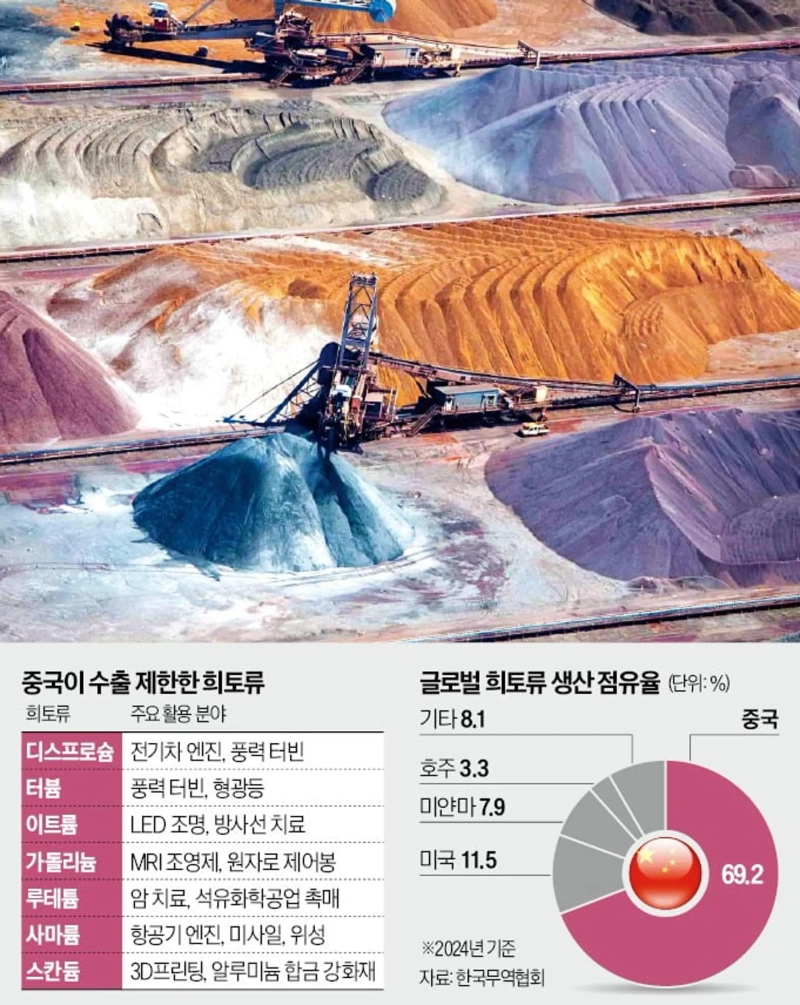

On April 4, China imposed export restrictions on seven types of rare earths—samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium—as well as magnets containing them. This was a retaliatory measure following the US’s prior announcement of reciprocal tariffs on China and other trading partners.

There is a reason Secretary Lutnick stressed resolving rare earth issues. China has a dominant share in rare earth production. As of last year, China held 69.2% of the share of global rare earth production. For gadolinium, China accounted for 99% of global output. Jim Hedrick, head of US Critical Materials, pointed out, "There is no US security issue more urgent right now than securing rare earths."

◇ Impact on Nuclear Reactors and Fighter Jets

The effects of the Chinese export restrictions appeared immediately. Due to a shortage of gadolinium, a vital material for nuclear reactor control rods, Électricité de France (EDF) halted its reactor upgrade work last month. The share price of Ørsted, the world's largest offshore wind company, dropped by more than 20% following China’s export restriction announcement, due to concerns over a lack of terbium needed for wind turbine manufacturing. The US Department of Defense, worried about the shortage of samarium—an essential component for aircraft and missiles—decided to build a plant for alternative materials. About 50 pounds of samarium are used in an F-35 fighter jet.

Some companies have reduced production because of a dysprosium shortage, which is critical for electric vehicle manufacturing. India’s largest automaker, Maruti Suzuki, decided to cut production of its e-Vitara electric vehicle to less than a third of the original plan. Japanese company Suzuki also halted production of its subcompact Swift cars as of the 26th of last month. Frank Eckardt, CEO of German magnet manufacturer Magnosphere, said, "The entire auto industry is in a complete panic, and automakers are prepared to buy (rare earths) at any price."

Prices of some rare earths have soared. According to Strategic Metals Invest, as of the 10th, the price of terbium rose by 42.0% compared to January 1st. Over the same period, dysprosium increased by 28.5%.

◇ Will the US-China Agreement Solve It?

Even after a compromise between the US and China, there are concerns that rare earth supply chain issues could flare up again at any time. Mark Smith, CEO at mineral exploration company NioCorp Developments, warned, "China can play the rare earth card whenever needed." China’s rare earth export restrictions, adopted in April as retaliation against the US, essentially make it possible to halt exports at any time. Previously, China had only set export quota limits or increased export taxes, which made the controls less strict.

To reduce reliance on China for rare earths, some countries are seeking diverse strategies. The G7 also plans to announce supply chain diversification measures for key strategic materials—including rare earths—by the end of the year in order to reduce dependence on China. The agenda is expected to be discussed at the G7 summit in Canada this month.

However, some analysts say that it is difficult to reduce China’s dominance in rare earth production in the short term. China accounts for 85~90% of the world’s rare earth refining and separation processes. Even if rare earths are sourced elsewhere, production for industrial use must go through China. Experts also point out that severe pollution occurs during rare earth refining, making it impossible for other countries to compete with China on production costs.

Sangmi An / Washington = Seungeun Lee, Correspondent / Juwan Kim, Reporter saramin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![Liquidity strains deepen as trading volume contracts and funds exit…Can altcoins rebound? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/5fa259b1-0308-4c7b-9259-04f38ad8fc2a.webp?w=250)