Trump-triggered rare metal price surge by 6 times... Samsung and SK on 'high alert'

Summary

- The article reported that due to China's export controls, the prices of rare metals have skyrocketed, putting domestic semiconductor and defense companies on high alert.

- The industry is focusing all efforts on securing inventory and diversifying import sources to respond to this situation.

- There are concerns that rare metal supply shortages in a situation of high dependence on China could cause disruptions to the defense industry and battery production.

Defense and semiconductor material shortage

Bismuth price at all-time high

Antimony also surged more than 4 times

China accounts for half of world production

China controls exports in response to US 'tariff bomb'

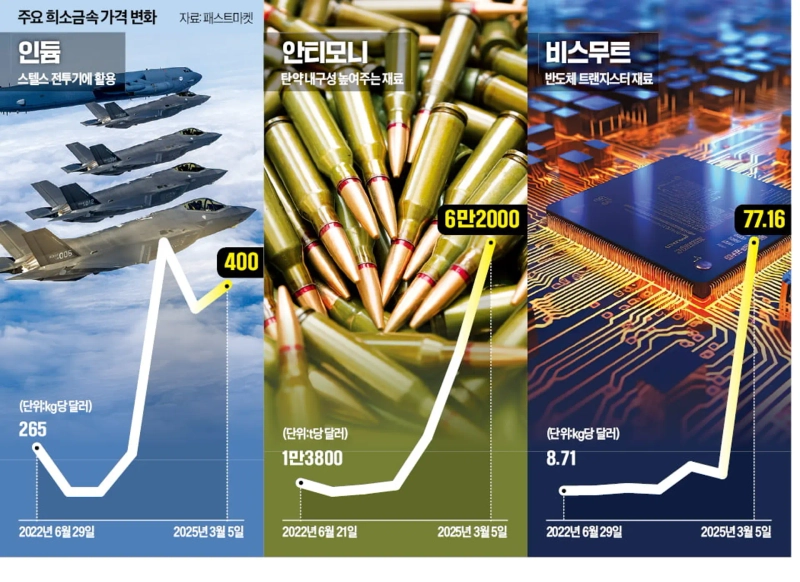

Prices of rare metals such as antimony and bismuth, which are essential in manufacturing semiconductors, batteries, and advanced weapons, are skyrocketing. This is due to China, which accounts for more than half of global production, implementing export controls in response to US 'tariff bombs.' Domestic companies are securing inventory and diversifying import sources to prepare for soaring rare metal prices and supply instability.

According to market research firm Fastmarkets on the 9th, bismuth, used in semiconductors, bulletproof glass, and ammunition manufacturing, recorded an all-time high of $77.16 per kg on the 5th. This is about six times higher than $13.23 on January 3rd this year, achieved in just over two months. Bismuth is experiencing shortages as China, which accounts for 80% of global production, controls exports. The Chinese government began regulating exports of five rare metals including bismuth, indium, and tungsten on the 4th of last month after the US imposed a 10% tariff on Chinese imports.

The price of antimony, a key defense material used in ammunition, missiles, and shells, has also surged. Antimony, which was $13,300 per ton on January 19th last year, rose to $62,000 on the 28th of last month, a 4.7-fold increase in one year. This is the result of China's export controls that began last September. The price of indium, used in display panels and solar panels, rose 53.9% from $260 per ton a year ago to $400 on the 5th.

The industry is on high alert. This is because major domestic industries such as semiconductors, batteries, displays, and defense could be directly impacted. Major companies are checking their stockpiles of rare metals while focusing on securing import sources outside China. Korea Zinc and LS MnM, which obtain antimony, indium, and selenium as byproducts during the refining of zinc and copper, are pursuing plans to increase rare metal production.

Defense and semiconductor key material prices soaring... Industry on alert over "supply disruption concerns"

US 'tariff bomb' butterfly effect... Skyrocketing rare metal prices

What ultimately determines the performance of advanced weapons is subtle differences. Rare metals create these subtle differences that make weapons relatively more resistant to external impacts and withstand high temperatures. According to the US Congressional Research Service, F-35 stealth fighters contain 417kg, Aegis ships 2,358kg, and Virginia-class nuclear submarines 4,172kg of rare metals. Stealth fighters use indium, which absorbs enemy radar waves, while intercontinental ballistic missiles (ICBMs) use beryllium as warhead protection material.

The problem is that China supplies about 90% of rare metals. This is why China first pulled out rare metal export controls during the trade war with the US. The industry worries that if rare metal supply shortages persist for a long time, it could disrupt not only the defense industry but also semiconductor and battery production.

Price surge due to US-China conflict

According to the industry on the 9th, indium rose 5.3% from $380 to $400 per ton from the beginning of the year until the 5th. Compared to January 3rd last year ($260 per ton), it increased by 53.9%. Indium is not only used as an electromagnetic wave absorbing material in stealth fighters but also in semiconductor substrates, solar panels, and display panels. Antimony, which enhances ammunition durability and is used as a protective clothing material, rose 366.2% from $13,300 per ton on January 19th last year to $62,000 on the 28th of last month. Bismuth surged 483.2% in just over two months until the 5th of this year.

Rare metal prices are rising because demand has increased significantly due to the Ukraine war, while supply has decreased sharply due to China's export controls. China has used rare metal export controls as a pressure card whenever conflicts arise. The 2010 rare earth export control measures against Japan are a prime example.

China is blatantly "weaponizing resources." When the US raised tariffs on Chinese products, China controlled exports of gallium, used in displays and solar materials, and germanium, used in thermal sensors, in August 2023, and banned the export of rare earth processing technology in December of that year. Since September last year, it has also blocked antimony exports. Recently, when the US imposed an additional 10% tariff on all Chinese imports, China activated export control measures for tungsten, bismuth, indium, etc. in retaliation.

Industry concerns about potential fallout

The industry and government are tense about the rise in rare metal prices. This is because the cost burden for semiconductor companies such as Samsung Electronics and SK Hynix could increase if the prices of indium, gallium, germanium, and antimony rise. Battery companies are closely watching the price trends of dysprosium and molybdenum. Dysprosium is an essential material for electric vehicle motors, and molybdenum is essential for secondary battery electrodes.

The defense industry is most concerned about tungsten and bismuth. Domestic companies use a strategy of mass-selling conventional weapons containing these rare metals rather than selling small quantities of advanced weapons, and they worry that if costs rise, the "low price" merit, which is the core competitiveness of K-defense, will decrease.

Considering these points, major companies have moved to secure rare metal inventories. The government has begun to assess the inventory of tungsten and molybdenum, which have 85-90% dependency on China. It is known that there are about six months of tungsten and three months of molybdenum in stock.

Some rare metals can be procured domestically. Korea Zinc extracts about 3,600 tons of antimony annually during the zinc and lead smelting process. It plans to produce more than 4,000 tons this year and export to the US and other countries. Some argue, "Let's use Korea Zinc's antimony as a tariff negotiation card with the Trump administration," because USAC, the only company producing antimony in the US, has an annual production of only 1,920 tons.

Indium is an item for which domestic companies, including Korea Zinc, have a global market share of 11%. LS MnM produces 680 tons of selenium and 50 tons of tellurium annually, which are used as materials for semiconductors and solar power generation.

▶ Rare Metals

Metals that are produced in small quantities and have limited production sites. These include antimony, an essential material for missiles, lithium and molybdenum used in semiconductors and secondary batteries, and rare earth elements (17 types including lanthanum, dysprosium, etc.)

Kim Wooseop/Sung Sanghoon Reporters duter@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)