간단 요약

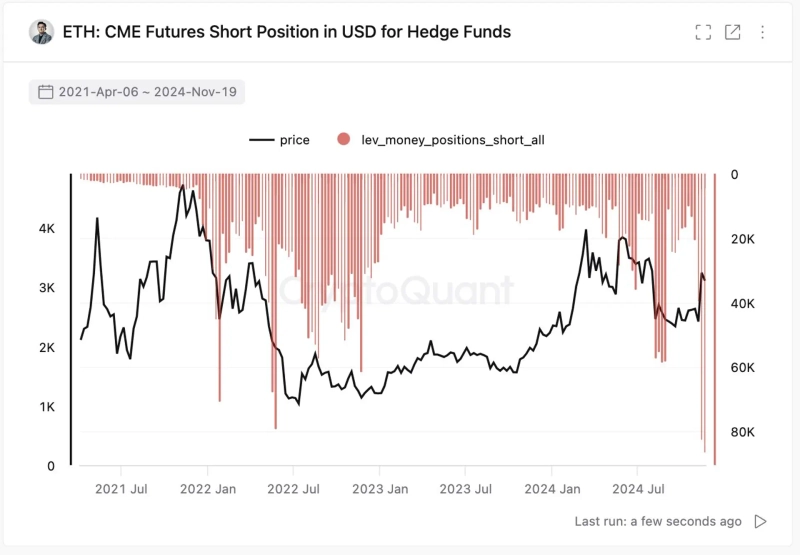

- CME에서 헤지펀드 발 이더리움 숏포지션이 최고치를 기록했다고 밝혔다.

- 롱 포지션과 이더리움 현물 ETF에 대한 수요도 동시에 증가했다고 전했다.

- 이는 기관 투자자들의 이더리움 현물 ETF 수요가 계속 증가할 것이라고 전했다.

헤지펀드의 시카고상품거래소 이더리움 숏포지션이 최고치를 기록한 것으로 나타났다.

28일(현지시각) 주기영 크립토퀀트 대표는 X를 통해 "시카고상품거래소에서 헤지펀드의 숏포지션은 최고치를 기록했다"라면서도 "롱 포지션과 이더리움 현물 ETF에 대한 수요도 동시에 증가했다"라고 밝혔다. 이어서 "이는 현금 및 캐리 거래 영향으로 보인다"라며 "이는 개인투자자가 아닌 기관 수요에 따른 수요가 존재함을 시사한다"라고 전했다.

앞서 주기영 대표는 "기관 투자자들의 이더리움 현물 ETF 수요가 증가하고 있다"라며 "비트코인과 마찬가지로 이더리움 현물 ETF 수요는 계속 증가할 것"이라고 말한 바 있다.

손민 기자

sonmin@bloomingbit.io안녕하세요 블루밍비트 기자입니다.