Editor's PiCK

'Digital Gold' Bitcoin's Position Solidifies… High Interest Rates Could Be a Headwind

Summary

- Bitcoin is likely to show a mid to long-term upward trend due to the pro-crypto policies of the Trump administration.

- Prolonged high interest rates could negatively impact Bitcoin prices, and the uncertainty of Trump's policies could act as a risk factor.

- Although the advancement of quantum computers raises security concerns for Bitcoin, experts recommend a strategy of installment investment to lower the average purchase price.

"Some Predict $200,000 This Year"

Trump Implements Pro-Crypto Policies

Corporate and Pension Fund Investment Expansion is a Boon

"Even with Short-term Adjustments, Long-term Rise"

Interest Rate Uncertainty Acts as a Variable

Security Concerns with Quantum Computer Advancements

Last year, Bitcoin surpassed the dream prices of 100 million KRW and $100,000 (approximately 147 million KRW) one after another. This year, rosy forecasts for Bitcoin continue. With the inauguration of U.S. President-elect Donald Trump, there is analysis that Bitcoin will further solidify its position as 'digital gold.' Some argue that since the positive factors are already reflected in the price, there is a possibility of adjustments.

○'Bitcoin President' Trump Inauguration

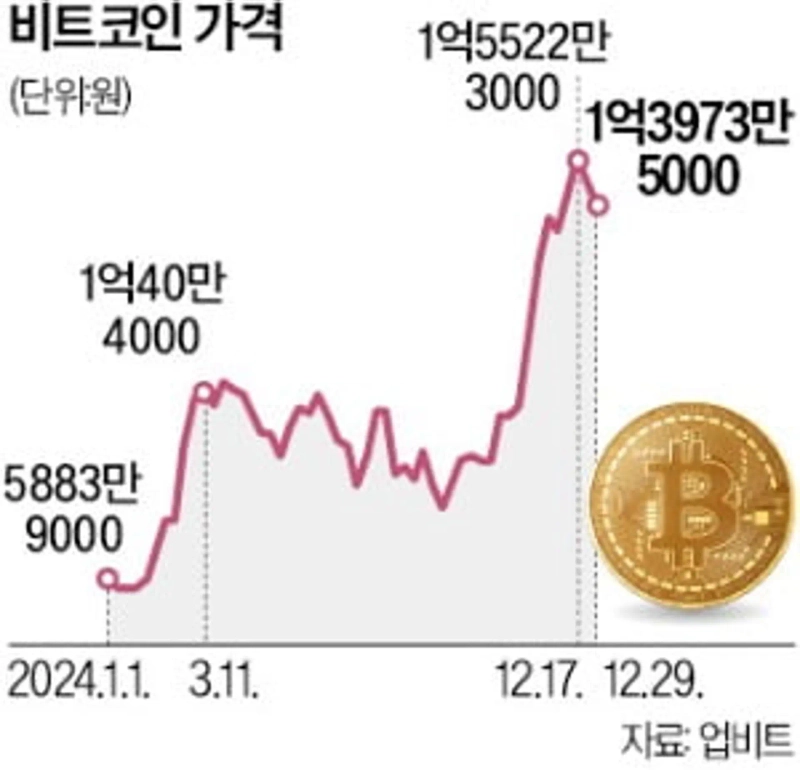

According to the domestic cryptocurrency exchange Upbit on the 2nd, the price of Bitcoin soared from 58,839,000 KRW at the beginning of last year to 157,198,000 KRW at one point on the 17th of last month. The annual growth rate is about 160%. In overseas markets, it also recorded an all-time high, reaching $108,249 at one point. It ended the 'crypto winter' (a long-term downward trend in cryptocurrencies) that began in the first half of 2022 and entered a new upward phase.

The sharp rise in Bitcoin prices last year was largely due to two positive factors. First, the approval of the Bitcoin spot Exchange-Traded Fund (ETF) listing on the U.S. stock market led to a large influx of new funds into the market. The election of former President Trump, who declared himself the 'crypto president,' also stimulated buying.

This year, what cryptocurrency investors are most paying attention to is the launch of the second Trump administration. Previously, President-elect Trump raised expectations by presenting specific pledges to revitalize the cryptocurrency market during his presidential campaign. Specifically, policies such as △strategic Bitcoin reserves △support for the Bitcoin mining industry △repeal of cryptocurrency regulations by the Joe Biden administration △establishment of a presidential advisory committee on virtual assets were announced.

President-elect Trump also threatened to fire Gary Gensler, chairman of the U.S. Securities and Exchange Commission (SEC), known as a 'crypto opponent,' on his first day in office. Paul Atkins, a former SEC commissioner and pro-crypto advocate, has been nominated as the next SEC chairman. In addition, pro-crypto advocates such as Vice President-elect JD Vance and Treasury Secretary nominee Scott Besant are heavily positioned in the second Trump administration.

The expansion of Bitcoin investment by global companies or financial institutions is also anticipated. Although the Bitcoin spot ETF was listed last year, institutional investment is still considered to be in its early stages. Some in the market speculate that U.S. retirement pensions (401K) may start buying Bitcoin in the future. Minho Lim, a researcher at Shinyoung Securities, said, "Financial institutions are also likely to invest in Bitcoin, which has a similar nature to gold, in the mid to long term," adding, "The overhang risk (potential large-scale sell-off) from structural issues such as Mt. Gox and German government holdings has mostly been resolved."

There are also expectations that Bitcoin will rise to the $200,000 range this year. Matt Hougan, Chief Investment Officer (CIO) of Bitwise Asset Management, argued, "Considering the supply reduction due to the halving and the new buying trend from companies and government agencies, the upward trend of Bitcoin will continue for the time being," and "Bitcoin could exceed $200,000 by the end of this year."

○Interest Rate Uncertainty Variable

However, the outlook for Bitcoin is not all rosy. Many are concerned that if the Trump administration's policies lead to prolonged high interest rates, it could negatively impact Bitcoin prices. If Trump's pledges, such as imposing universal tariffs and large-scale tax cuts, become a reality, inflation could intensify and the fiscal deficit could widen, which could result in the U.S. benchmark interest rate being lowered more slowly than expected.

There is also a possibility that the pro-crypto policies announced by President-elect Trump may not be implemented. Last month, Jerome Powell, chairman of the U.S. Federal Reserve (Fed), drew a line regarding the 'strategic assetization of Bitcoin.' This publicly indicated that the Fed would not cooperate with President-elect Trump's plan to stockpile Bitcoin as a strategic asset. Shortly after Powell's remarks, Bitcoin prices fell below the $100,000 mark.

Recently, Google announced the quantum computer 'Willow,' which affected Bitcoin. Concerns that quantum computers could decrypt Bitcoin's encryption impacted the price decline. However, there is also a counterargument that it will take 10 to 20 years for quantum computers to reach a level that poses a direct security threat to Bitcoin.

○"Invest in Installments and Diversify"

Even if Bitcoin prices undergo short-term adjustments, many expect the upward trend to continue in the long term. Experts advise, "Bitcoin has little correlation with traditional assets such as stocks and bonds and can be a means to hedge against inflation," and "a strategy of investing as part of a portfolio rather than 'all-in' is necessary."

Hedging high price volatility through installment investment is also a method. By purchasing Bitcoin weekly or monthly, like depositing into a savings account, you can be less affected by short-term price fluctuations and lower the average purchase price to increase returns.

There is also an interesting result showing how much you would have earned if you had invested in Bitcoin in installments. If you had invested $100 (about 150,000 KRW) in Bitcoin every week since early 2015, the principal would be a total of $52,200 (about 77 million KRW), but the valuation would be $3.29 million (about 490 million KRW).

Hyunggyo Seo seogyo@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)