Summary

- Bravo Research analyzed that Bitcoin reaching $80,000 will be a buying opportunity.

- The report warned of a price correction due to the record outflow of funds from the Bitcoin Spot ETF and the hawkish stance of the Federal Reserve.

- Bitcoin is likely to follow the stock market's bearish trend, and essential gains are not guaranteed regardless of ETF inflows.

An analysis has emerged suggesting that when Bitcoin (BTC) reaches $80,000, it will be a good opportunity to start buying at a low price.

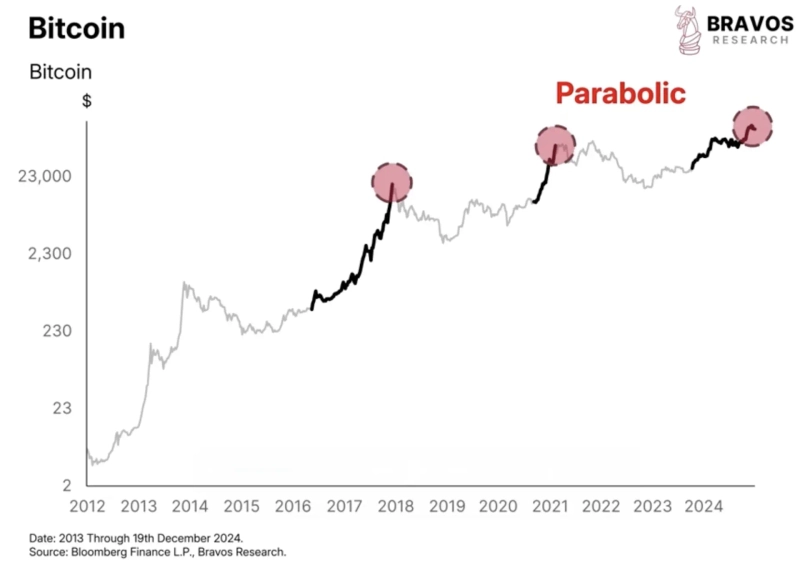

On the 2nd (local time), Bravo Research released a report stating, "The parabolic rise of Bitcoin earlier this year may falter," and analyzed that "$80,000 will be a buying opportunity." It continued, "Due to the record outflow of funds from the U.S. Bitcoin Spot ETF, a sluggish stock market, and a hawkish Federal Reserve, the bullish sentiment on Bitcoin is losing strength," warning that "there will be a price correction for Bitcoin."

The report noted, "While the stock market hit new highs last September, Bitcoin struggled," but added, "Ultimately, Bitcoin followed the bullish trend of the stock market." It further analyzed, "(Given the current sluggish stock market) Bitcoin is likely to follow the bearish trend of the stock market."

Furthermore, it advised, "Do not rely on net inflows of Bitcoin Spot ETF funds," pointing out that "even with inflows into Bitcoin Spot ETFs, Bitcoin prices may not necessarily rise." The report added, "An analysis of Bitcoin Spot ETF inflows suggests a potential for further Bitcoin gains, but if buying slows even slightly, a decline could occur," noting that "despite continued inflows into Bitcoin Spot ETFs last March, Bitcoin fell by 30%."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)