Summary

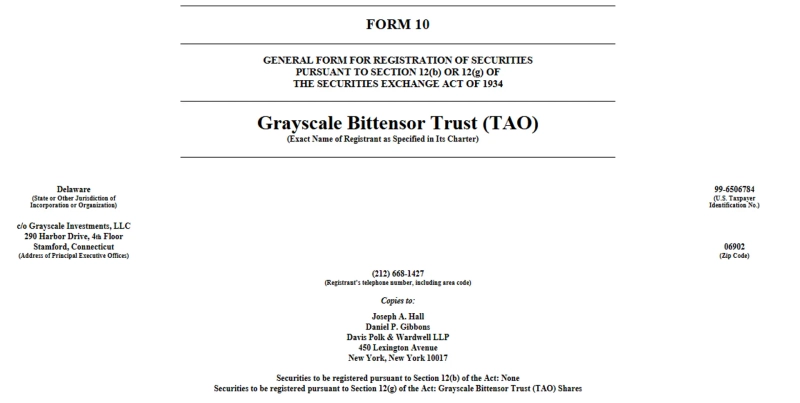

- Grayscale said it submitted related documents to the SEC to launch a BitTensor (TAO) trust product.

- It stated that if this filing is approved, the trust product would have to submit periodic reports and audited financial statements to the SEC.

- The BitTensor trust is expected to be publicly traded on the over-the-counter market upon approval.

Digital asset (cryptocurrency) asset manager Grayscale is reportedly planning to launch a BitTensor (TAO) trust product.

On the 13th (KST), crypto outlet BeInCrypto reported that Grayscale recently filed the basic documents (Form 10) for the BitTensor trust with the SEC.

Grayscale said on X (formerly Twitter), "We have filed the basic documents for the BitTensor trust product," adding, "This is a first step toward becoming an SEC-reporting company and will serve to take accessibility, transparency and regulatory status to the next level."

If this filing is approved, the BitTensor trust product will, like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), be required to file periodic reports (10-K, 10-Q) and audited financial statements with the SEC, and will be publicly traded on the over-the-counter market.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.