간단 요약

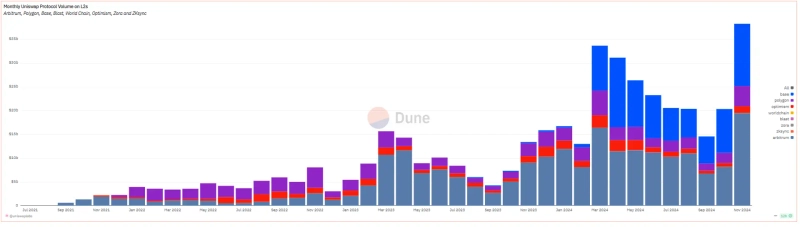

- 유니스엑스는 아비트럼, 폴리곤, 옵티미즘과 같은 주요 이더리움 L2 네트워크에서 약 380억 달러의 거래량을 기록했다고 전했다.

- 이는 지난 3월 기록한 최고 기록을 약 40억 달러 상회하는 수준이라고 밝혔다.

- 헬릭 앤더스 아폴로 크립토 최고투자책임자는 유니스엑스 거래량 증가가 더 광범위한 디파이 생태계 자산과 스테이블코인에 대한 수요가 증가한 데서 기인한다고 설명했다.

가상자산(암호화폐) 시장에 대한 투자자들의 관심이 높아지면서 탈중앙화 금융(DeFi) 수요도 높아지고 있다.

28일(현지시간) 가상자산 전문 미디어 코인텔레그래프는 듄 애널리틱스 데이터를 인용해 "유니스왑은 베이스, 아비트럼(ARB), 폴리곤(POL), 옵티미즘(OP) 등 주요 이더리움 L2 네트워크에서 무려 380억달러의 거래량을 기록했다. 이는 지난 3월 기록한 최고 기록을 약 40억달러 상회하는 수치다"라고 전했다.

헨릭 앤더스 아폴로 크립토 최고투자책임자는 "유니스왑 거래량이 증가한 것은 더 광범위한 디파이 생태계 자산과 스테이블코인에 대한 수요가 증가한데서 기인한다"라며 "최근 상승세는 이더리움 생태계가 오랫동안 기다려온 성과의 시작일 수 있다"라고 덧붙였다.

이영민 기자

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![트럼프 때문에 폭락했다고?…비트코인 무너진 '진짜 이유' [한경 코알라]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)

!['AI에 우리 일거리 뺏기나' 공포…주가 급락에 발칵 뒤집힌 곳 [뉴욕증시 브리핑]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)