PiCK 뉴스

'초강력 트럼프 랠리' 아직 안 끝났다…"비트코인, 97.5k 돌파시 상승 재개" [강민승의 트레이드나우]

간단 요약

- 비트코인(BTC)은 최근 9만7500달러의 안정적인 저항선을 돌파할 경우 상승세를 이어갈 가능성이 크다고 분석됐다.

- 특히 대규모 투자자들의 적극적인 매수세가 강세장을 지속시킬 수도 있다고 전문가들은 언급했다.

- 반면 비트코인이 9만500달러 아래로 떨어질 경우 강력한 하락세가 진행될 수 있다는 전망도 나왔다.

“비트코인, 97.5k 안정 돌파시 상승 전망"

"89.8k 하회시 낙폭 확대 가능성"

자신을 ‘암호화폐 대통령’으로 칭한 도널드 트럼프가 미 대통령으로 당선되면서 47% 급등한 비트코인(Bitcoin, BTC)은 단기 조정을 받고 9만5000달러 부근에서 다시 상승을 시도하고 있다.

시장 전문가들은 비트코인이 9만7500달러를 안정적으로 돌파하면 강세장을 이어갈 가능성이 높지만 8만9800달러 지지선을 반납할 경우 추가 하락 가능성이 높아질 수 있다는 분석을 내놨다.

28일 오후 17시 58분 기준 현재 업비트 원화 마켓에서 비트코인은 전일 대비 0.06% 오른 1억3307만원(바이낸스 USDT 마켓 기준 9만5449달러)에 거래되고 있다. 같은 시각 김치 프리미엄(해외 거래소와 국내 거래소의 가격 차이)은 역프리미엄을 나타내며 -0.55%를 기록하고 있다.

“美 인플레이션 지표 다시 높아져…추가 금리인하 신중론”

최근 글로벌 증시는 미국 중앙은행(Fed)이 중시하는 인플레이션 지표가 둔화세를 멈추고 다시 높아지면서 소폭 약세를 보였다. 다만 가상자산(암호화폐)을 비롯한 전반적인 시장 흐름에는 크게 영향을 미치지는 않은 것으로 보인다. 경제지표가 시장 예상치에 부합하고 Fed의 금리 정책을 방해하지 않는 수준이어서다.

지난 27일 미 상무부는 미국의 10월 근원 개인소비지출(PCE) 가격지수가 1년 전보다 2.8%, 지난달보다 0.3% 각각 상승했다고 밝혔다. 근원 PCE는 시장의 예상치에 부합했지만 올해 4월 이후 6개월 만에 가장 높은 수준을 기록했다. 구체적으로 서비스 물가가 큰 폭으로 상승하며 인플레이션 우려를 자극했다.

근원 PCE는 변동성이 높은 식품과 유가 등 에너지를 제외한 물가 지수로 Fed가 기준금리 결정 등 정책 고려에 앞서 참고하는 주요 지표로 꼽힌다.

시장은 이번 발표된 지표가 Fed의 금리인하 신중론을 뒷받침할 것이라고 예상하고 있다. 앞서 발표된 미국의 10월 소비자물가지수(CPI)는 7개월 만에 오름세로 반전했고 도매물가로 불리는 생산자물가지수(PPI)도 둔화세가 주춤하며 인플레이션에 대한 경계감을 높인 바 있다. 또한 제롬 파월 Fed 의장은 금리 인하에 신중할 필요가 있다며 속도조절을 시사하기도 했다.

이날 미 경제 매체 CNBC는 “10월 근원 PCE는 더욱 강력한 수치를 나타냈다. 지표 발표에 증시는 혼조세를 보였고 국채 수익률은 하락했다”라고 전했다. 블룸버그는 “미 인플레이션은 여전히 완고한 것으로 나타났고 Fed의 목표치인 2%에 근접하려면 시간이 더 걸릴 것으로 보인다”면서도 “(실질적) 금리 인하 경로는 트럼프의 정책 방향으로 인해 복잡해질 수 있다”라고 전망했다.

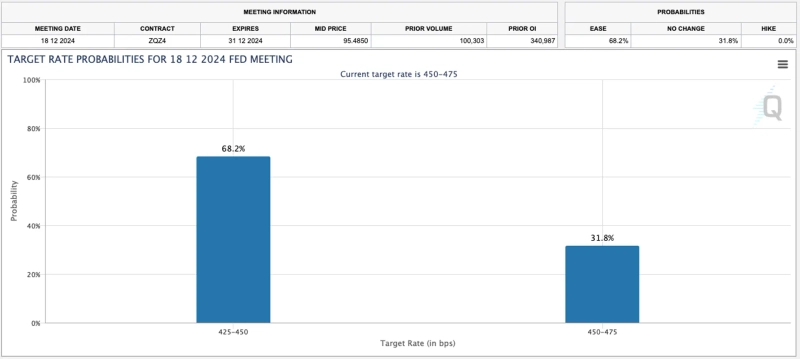

한편 금리선물 시장은 12월 금리 인하 가능성을 높여잡고 있다. 이날 오후 18시 시카고상품거래소(CME) 페드워치에 따르면 Fed가 12월 기준금리를 0.25%포인트 인하할 가능성은 전날보다 약 9%포인트 정도 상승한 68.2%를 나타내고 있다. 반면 금리를 동결할 가능성은 31.8%로 반영됐다.

블랙록, 비트코인 옵션 '화려한 데뷔'…“유동성 증가·기관 채택 늘어날 것”

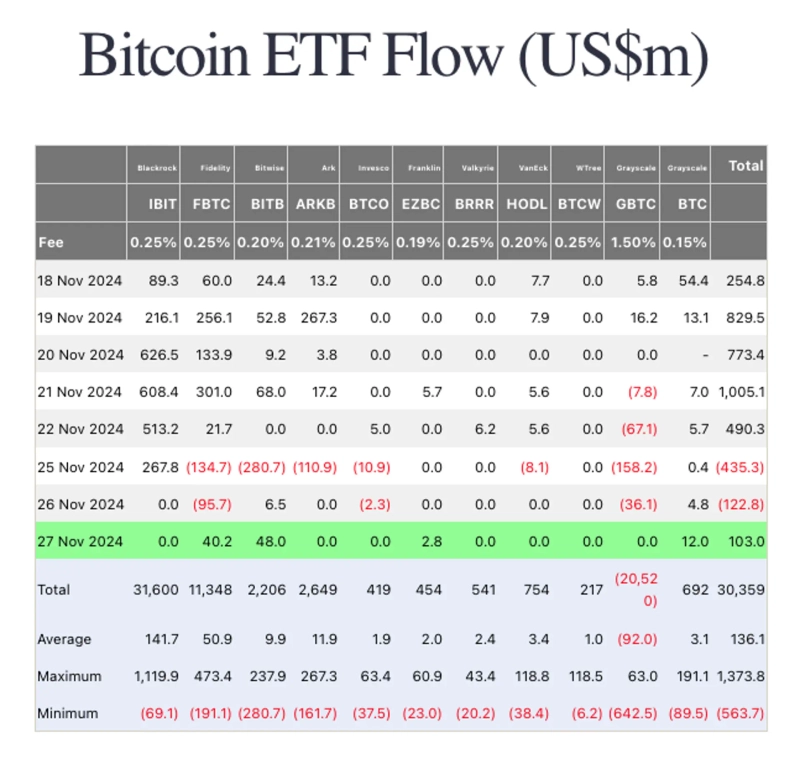

비트코인 현물 상장지수펀드(ETF)는 지난주(지난 18일~22일) 33억5310만달러(약 4조6708억원)의 역대 최대 유입액을 달성했지만, 이후 2거래일 연속 순유출을 보였다. 최근 트럼프 행정부가 친가상자산 인사를 확대하고 있다는 소식, 마이크로스트래티지의 5만5500 BTC 추가 매수, ‘가상자산 저승사자’ 게리 겐슬러 미국 증권거래위원회(SEC) 위원장이 사임 의사를 표명한 점 등이 상승세에 힘을 보탰다.

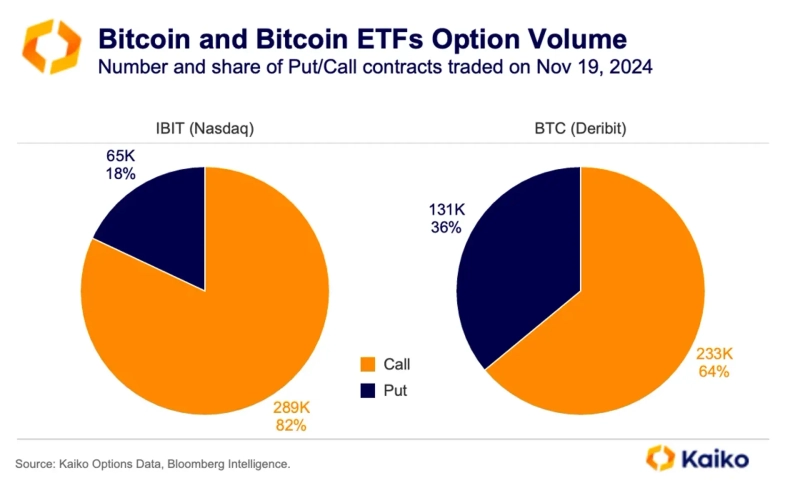

특히 뉴욕증시에 블랙록의 비트코인 옵션이 상장하면서 낙관론이 크게 확산했다. 가상자산 데이터 분석 기업 카이코는 최근 연구 보고서를 통해 "지난주 상장한 블랙록의 비트코인 현물 ETF 옵션은 거래 첫날 약 19억달러 거래량을 기록했다"면서 "그중 80%는 가격 상승에 베팅하는 콜옵션으로 구성돼 투자자의 강력한 수요와 강세 전망을 나타냈다"라고 밝혔다.

카이코는 "최근 비트코인 현물 ETF에 기반해 출시된 옵션 상품 여럿은 시장 유동성을 크게 높이고 기관의 채택을 가속화할 수 있다"면서 "(암호화폐) 파생상품 시장에서 기관의 모멘텀은 확대되고 있다. 지난주 시카고상품거래소(CME)의 비트코인 선물 미결제 약정(OI)도 약 220억달러(약 30조6790억원)로 사상 최고치를 잇따라 경신했다"라고 덧붙였다.

미결제 약정이란 선물·옵션 같은 파생상품 계약에서 아직 결제가 이뤄지지 않은 계약을 의미한다. 미결제 약정 규모가 늘어난다는 것은 시장으로 자금이 유입되고 있다는 의미다. 특히 투자 규모가 큰 기관 투자자는 일반적인 코인 거래소보다는 대부분 CME에서 거래한다.

“차익실현 나선 장기 투자자, 매도세 확대 가능성…중기적 상승 전망”

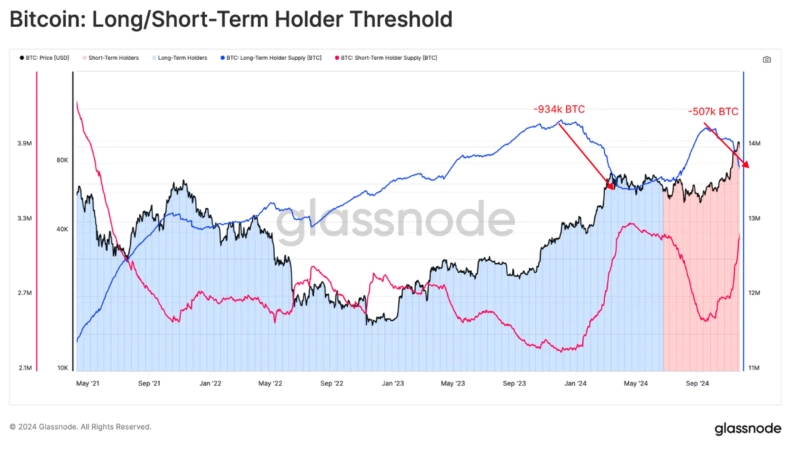

시장의 낙관적인 분위기와 달리 장기 투자자의 추가적인 매도세가 유입될 수 있다는 전망도 나온다. 온체인 분석 플랫폼 글래스노드(Glassnode)는 지난 26일 주간 보고서를 통해 “비트코인은 10만달러에 매우 가까워졌고 장기 투자자들은 대규모 매도에 나서고 있다”라고 분석했다.

이어 “비트코인을 6개월 이상 1년 미만 홀딩한 장기 투자자들은 최근 폭발적인 상승세에 미실현 이익이 급증했고 50만7000 BTC를 매도했다”라고 전했다. 보고서는 "비트코인 시세가 더 상승할 경우 비트코인을 1년 이상 홀딩한 장기 투자자의 매도세가 이어질 가능성이 높다"라고 덧붙였다.

글로벌 가상자산 거래소 비트파이넥스는 주간 연구 보고서를 통해 "비트코인이 지난달 전고점(7만3666달러)를 돌파한 이후 장기 투자자들은 지금까지 46만1000 BTC 이상 매도했다"면서 "현재 매도 압력이 높아지고는 있지만 지난 3월, 2021년 3월 강세장 당시 매도세에 비하면 여전히 낮은 편"이라고 진단했다. 이어 "상승 모멘텀은 일시적으로 정체될 수 있지만 ‘건전한 숨 고르기’로 보인다. 시장은 매도 압력을 흡수하고 중기적으로 상승세를 이어갈 가능성이 높다"라고 전망했다.

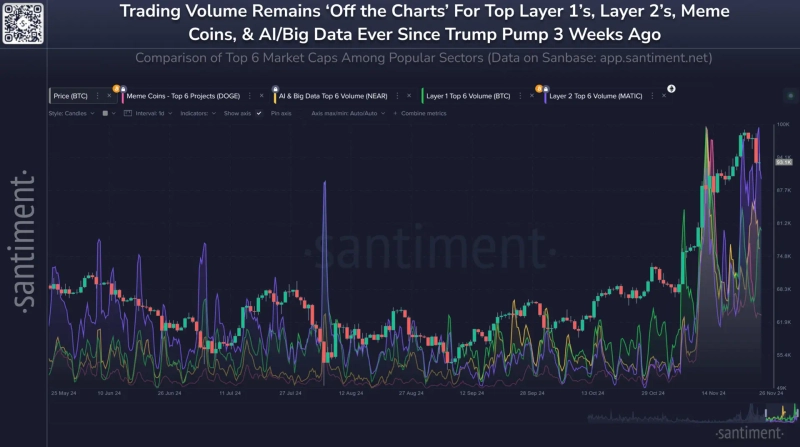

투자자의 차익 실현에도 전체 거래량은 증가세를 지속하고 있다. 가상자산 데이터 분석업체 샌티멘트는 지난 27일 "11월 온체인 거래량은 활발하게 증가했다. 특히 지난 12일에는 거래량이 1549억2000만 BTC을 기록하며 지난 5월 이후 정점을 찍었다"라고 밝혔다. 또 "비트코인이 사상 최고가를 달성한 이후 투자자가 차익을 실현하며 자금이 알트코인으로 빠르게 옮겨가고 있다”면서 “전체 (암호화폐 시장) 거래량은 이달 마지막 주 들어 32% 급증했다"라고 설명했다.

한편 트위터, 레딧 등 소셜네트워크서비스(SNS)에선 비트코인의 강세와 약세를 전망하는 게시글이 모두 증가하고 있다. 샌티멘트는 "최근 트위터 등에선 비트코인이 10만달러에 도달할 것이란 언급이 크게 늘었고, 이는 투자자의 포모(FOMO, 상승장에서 혼자 소외되는 것에 대한 공포감)를 반영한다"라고 밝혔다. 또 "비트코인이 60-79k 가격으로 복귀할 것이란 언급은 퍼드(FUD, 두려움과 불확실성, 의심)를 자극하고 있지만 시장의 상승 재료로도 작용하고 있다"라고 분석했다.

“비트코인, 9만7500달러 안정 돌파시 상승세 지속 전망”

시장 전문가들은 비트코인이 9만7500달러 저항선을 돌파하면 상승세를 이어갈 가능성이 높다고 전망했다. 반면 비트코인이 9만3500달러 지지선을 깨고 내려오면 추가 하락 가능성이 더욱 높아진다는 분석도 내놨다. 온체인 분석가들은 최근 한 달 동안 주요 거래소에 유입된 스테이블코인이 97억달러(약 13조5000억원)를 넘어서면서 시장의 매수력이 커지고 있다는 분석을 내놨다.

비트코인은 단기 지지선을 반납하고 9만달러 부근까지 내려왔다가 다시 상승세를 시작했다. 아유시 진달 뉴스비티씨 연구원은 “비트코인은 9만7500달러 근방에서 단기 조정을 시작했고 9만736달러에서 저점을 다지고 다시 상승하고 있다”면서 "비트코인이 9만5750달러 저항선을 돌파하면 큰 상승이 시작될 수 있을 것”이라고 분석했다.

분석가는 "비트코인이 상승세를 이어간다면 9만7500달러선을 시험하고 9만8000달러까지 도달할 수 있다"면서도 "만약 비트코인이 9만3500달러를 하회할 경우 9만1800달러, 9만500달러까지 후퇴할 수 있다. 9만달러를 반납하면 8만8000달러까지 낙폭을 확대할 수 있다"라고 덧붙였다.

라케시 우파드예히 코인텔레그래프 연구원은 “비트코인이 ‘심리적 저항선’ 10만달러를 돌파하면 11만3331달러, 12만5000달러까지 상승폭을 확대할 수 있을 것”이라고 전망했다. 그는 “비트코인이 (일봉 기준) 8만9857달러 하방 돌파할 경우 낙관적인 전망은 무효화된다. 8만5000달러까지 추가 하락할 수 있다”라고 덧붙였다.

우파드예히는 “비트코인 현물 ETF의 대규모 자금 유입, 마이크로스트래티지의 추가 매수에도 불구하고 비트코인이 10만달러 벽을 뚫지 못한 것은 단기 투자자의 매도세를 자극할 수 있다”면서 “10만달러 돌파에 다시 실패할 경우 강한 되돌림이 발생할 수도 있다”라고 덧붙였다.

비트코인은 단기 하락에서 반등에 성공하며 매수세가 다시 유입되고 있다는 관측도 있다. 알렉스 쿠프치케비치 에프엑스프로 시장분석가는 “최근 비트코인은 투자자의 차익 실현과 글로벌 증시의 신중한 분위기 속에 (고점 대비) 약 9% 하락했다”면서도 “시장에선 반등이 나오면서 매수세가 돌아오고 있고 조정이 끝날 것이라는 기대감이 커지고 있다”라고 분석했다.

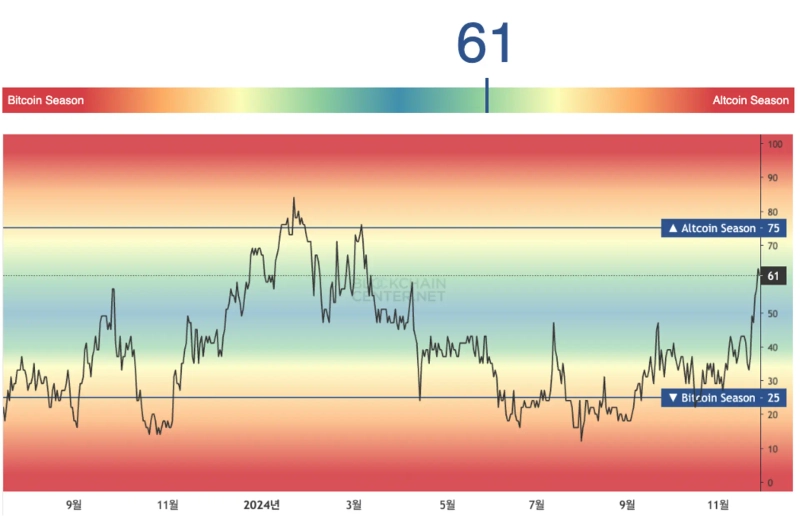

한편 수익을 쫓는 자금이 비트코인에서 알트코인으로 옮겨가고 있다는 분석도 나온다. 그는 “이번 비트코인의 조정은 (비트코인에 대한) 근본적인 투심이 악화했기 때문이 아니다. (비트코인) 투자자들이 수익성 쫓아 알트코인으로 옮겨간 영향이 크다”라고 진단했다.

이어 “알트코인은 현 가상자산 시장의 회복을 주도하고 비트코인도 이를 뒤따르게 될 것”이라고 전망했다. 이날 블록체인센터에 따르면 알트코인의 강세 지표인 ‘알트코인 시즌’ 지수는 일주일 새 28 오른 61을 나타내며 지난 4월 이후 최고치를 찍었다.

강민승 블루밍비트 기자 minriver@bloomingbit.io

강민승 기자

minriver@bloomingbit.io여러분의 웹3 투자 인사이트를 더해줄 강민승 기자입니다. 트레이드나우·알트코인나우와 함께하세요! 📊🚀