간단 요약

- "비트코인(BTC)"이 10만 달러를 앞두고 더 강한 매수세가 필요하다고 전했다.

- 현재 비트코인의 가격은 조정을 겪고 있으며, 단기 투자자들의 대량 매도가 원인으로 분석된다고 밝혔다.

- 새로운 고점 달성을 위해서는 소규모 및 기관 투자자들의 대량 현물 매수세가 중요하다고 언급했다.

비트코인(BTC)이 10만달러를 앞두고 숨고르기에 돌입한 가운데, 신고점 달성을 위해서는 더 강한 매수세가 필요하다는 분석이 나왔다.

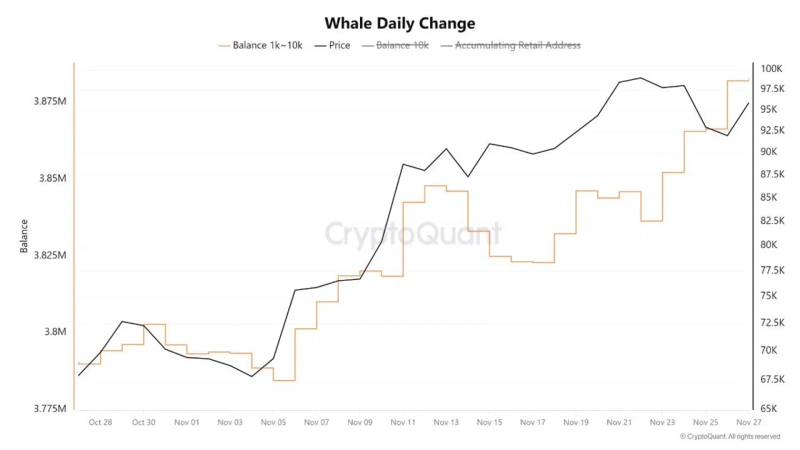

28일(현지시간) 온체인 데이터 분석 플랫폼 크립토퀀트의 기고가 'caueconomy'는 "현재의 매수세는 기관 투자자들에게 편중돼 있다. 새로운 고점 달성을 위해서는 소규모 및 기관 투자자들의 대량 현물 매수세가 필요하다"고 밝혔다.

한편, 현재 비트코인의 가격이 조정을 겪고 있는 것은 단기 투자자들의 대량 매도가 원인인 것으로 풀이된다. 최근 단기투자자들은 약 40억달러 규모의 비트코인을 매도했다.

이날 비트코인은 바이낸스 테더(USDT) 마켓에서 전일 대비 0.2% 하락한 9만5600달러대에서 거래되고 있다.

황두현 기자

cow5361@bloomingbit.io여러분의 웹3 지식을 더해주는 기자가 되겠습니다🍀 X·Telegram: @cow5361![[단독] 카카오뱅크, 글로벌 커스터디 강자와 회동…스테이블코인 협력 가능성](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![트럼프 측근 마이런 Fed 이사, 백악관 직무 사임…워시 올 때까지 금리인하 밀어붙이나[Fed워치]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)