간단 요약

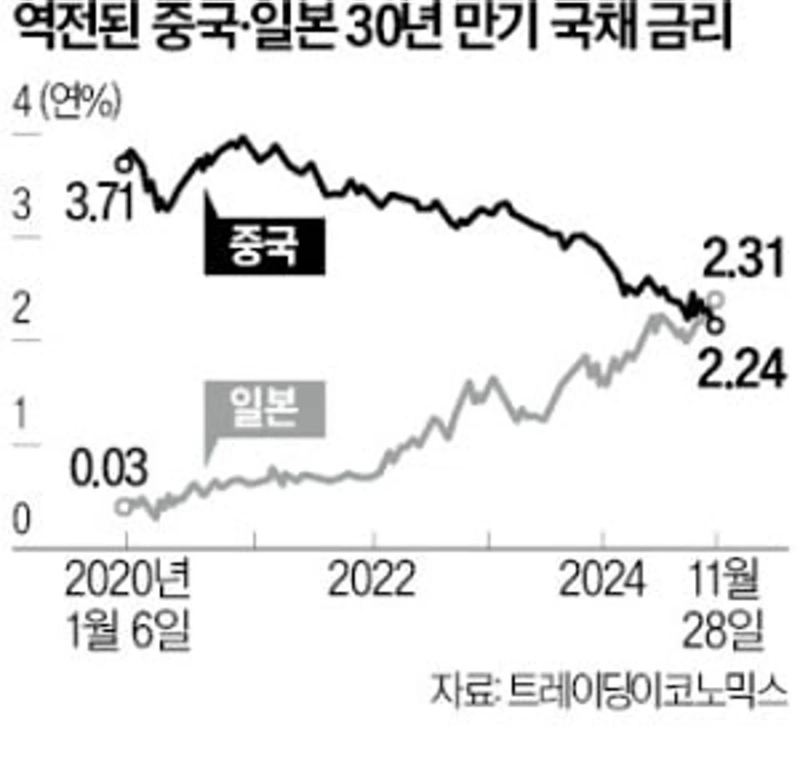

- 중국의 30년 만기 장기물 국채 금리가 일본의 금리를 넘어섰다고 전했다.

- 이는 중국 경제가 디플레이션에 빠질 가능성에 대한 우려를 반영한 것이라고 밝혔다.

- 중국 경제의 하락 가능성이 장기적으로 투자 위험을 높일 수 있음을 시사한다고 전했다.

중국도 '잃어버린 30년' 오나

중국의 장기물 국채 금리가 사상 처음으로 일본의 장기물 국채 금리를 밑돌았다. 글로벌 채권 투자자들이 세계 2위 경제 대국인 중국이 디플레이션에 빠질 것이란 전망에 베팅하고 있다는 분석이 나온다.

30년물 국채금리 日에 첫 역전…中, 경기침체 경고음 더 커졌다29일 파이낸셜타임스(FT)에 따르면 30년 만기 중국 국채 금리는 전날 연 2.24%를 기록해 연 2.31%를 나타낸 30년 만기 일본 국채 금리 밑으로 떨어졌다. 30년 만기 국채 금리에서 중국과 일본이 처음으로 역전된 것이다.

30년 만기 중국 국채 금리는 2020년 말 연 4%에서 지속적으로 하락하고 있다. 부동산 시장 침체 등으로 부진이 심화하는 자국 경제를 부양하기 위해 중국 인민은행이 기준금리를 내리고 있기 때문이다. 또 중국 시장 투자자들이 주식과 부동산 등 위험 자산에서 안전 자산인 채권으로 이동하는 흐름을 반영하고 있다는 분석이 있다. 반면 오랜 기간 연 1% 이하에 머물던 30년 만기 일본 국채 금리는 2022년 초부터 상승세를 탔다. 장기 디플레이션 이후 통화정책을 정상화하면서다.

일본보다 경제 성장 단계가 한참 낮은 중국의 장기 국채 금리가 일본 수준까지 떨어진 것은 그만큼 향후 성장에 빨간불이 켜졌음을 의미한다는 분석이 나온다. 시장 일각에선 중국의 디플레이션이 이미 고착화돼 당국의 재정정책이나 통화정책으로 쉽게 해결되지 않을 것으로 예상한다. 중국 장기물 국채 금리가 더 하락할 수 있다는 전망이다.

특히 최근 중국 경제의 특정 지표들이 일본이 1990년대 부동산 버블 붕괴 이후 몇십 년간 겪은 정체기의 전조 증상과 비슷하다는 분석도 잇따른다. 10월 중국의 근원 물가 상승률은 전년 동기 대비 0.2%에 그쳤다.

존 우즈 롬바르오디에은행 아시아 최고투자책임자(CIO)는 “중국 국채는 수익률이 점점 낮아질 것”이라며 “당국이 디플레이션을 어떻게 막을 수 있을지 전혀 확신할 수 없다”고 말했다. 도널드 트럼프 미국 대통령 당선인의 중국산 수출품에 대한 10%포인트 추가 관세 정책도 중국 성장세에 더 큰 타격을 줄 것이란 관측이다.

김리안 기자 knra@hankyung.com

한경닷컴 뉴스룸

hankyung@bloomingbit.io한국경제 뉴스입니다.

![고용 서프라이즈·AI 부담 겹쳤다…비트코인 7만달러 저항 속 변동성 확대 우려 [강민승의 트레이드나우]](https://media.bloomingbit.io/PROD/news/95764d70-5a3d-4300-b834-25c6a366c3a5.webp?w=250)